ERPC Releases Solana SWQoS RPC Endpoint: Faster Transactions via Staked Connection Dedicated Lanes

ERPC Releases Solana SWQoS RPC Endpoint: Faster Transactions via Staked Connection Dedicated Lanes

ELSOUL LABO B.V. (Headquarters: Amsterdam, The Netherlands, CEO: Fumitake Kawasaki) and Validators DAO announce the release of ERPC’s new RPC service, the SWQoS Endpoint. This allows both shared plans and dedicated RPCs to utilize stake connection dedicated lanes, delivering transactions faster and with higher certainty.

Background

We have built zero-distance network infrastructure and provided high-performance data streams such as ShredStream and gRPC.

Among the demands we constantly received was the need for transaction sending services.

With the stream infrastructure stabilized, we began development for sending, and today we are releasing the first product in this category: the SWQoS Endpoint.

Going forward, this will expand to the opening of the Solana Stake BandWidth Market and multi-region SWQoS Endpoints. Developers, traders, and validators all benefit, and the result is a more efficient Solana network overall.

What is SWQoS?

SWQoS (Stake Weighted Quality of Service) is a mechanism where validators with stake connections are prioritized. Leaders allocate about 80% of lanes to stake connections and 20% to non-stake connections. This means stake connections enjoy 5x the transaction BandWidth compared to non-stake connections.

This prioritization is applied before Priority fee evaluation, making SWQoS the prerequisite for fast processing.

Product Overview

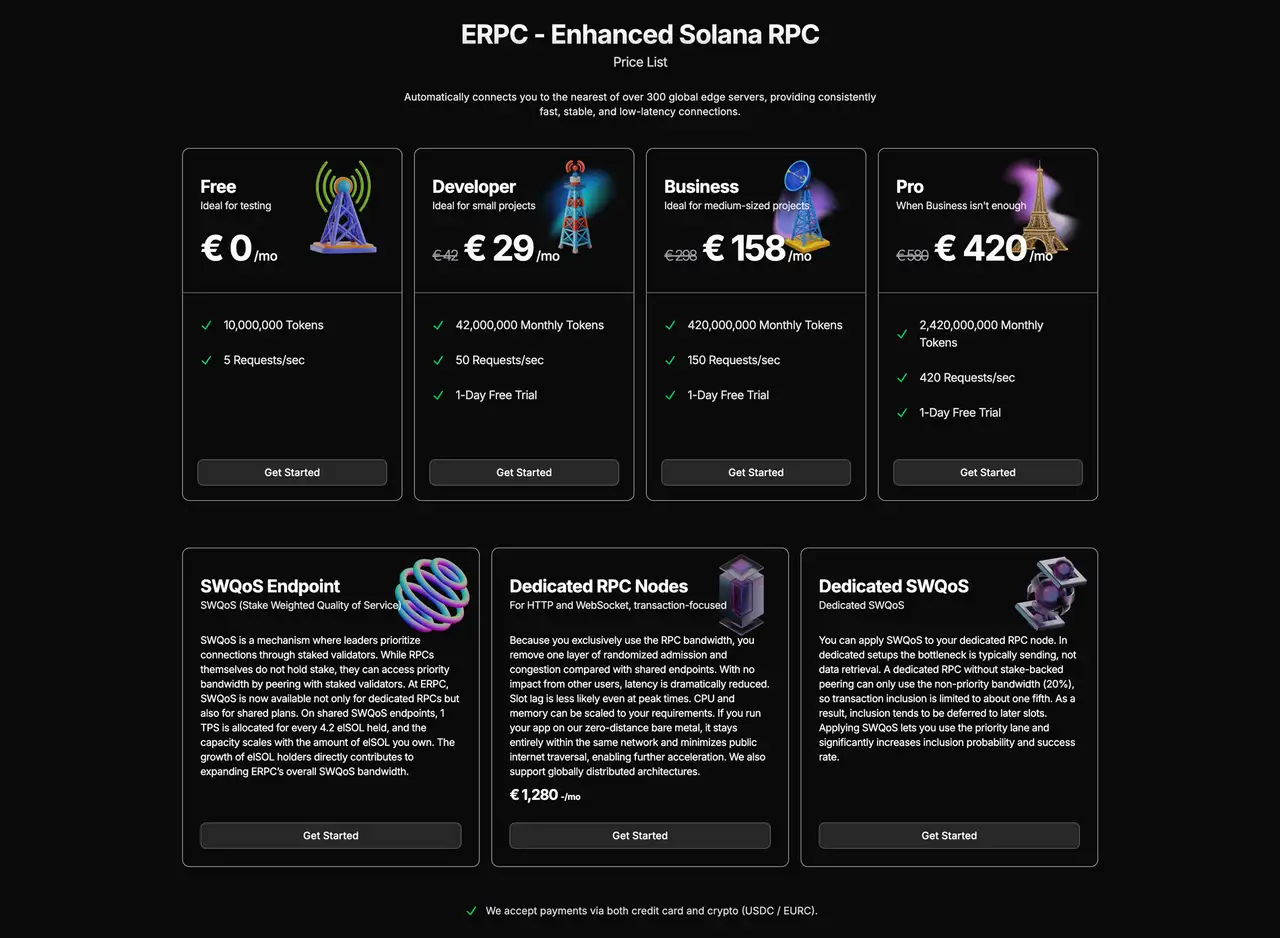

The newly released SWQoS Endpoint can be used with both shared plans and dedicated RPCs. The initial supported region is Frankfurt (FRA), with further expansion planned.

Cost Structure Transformation

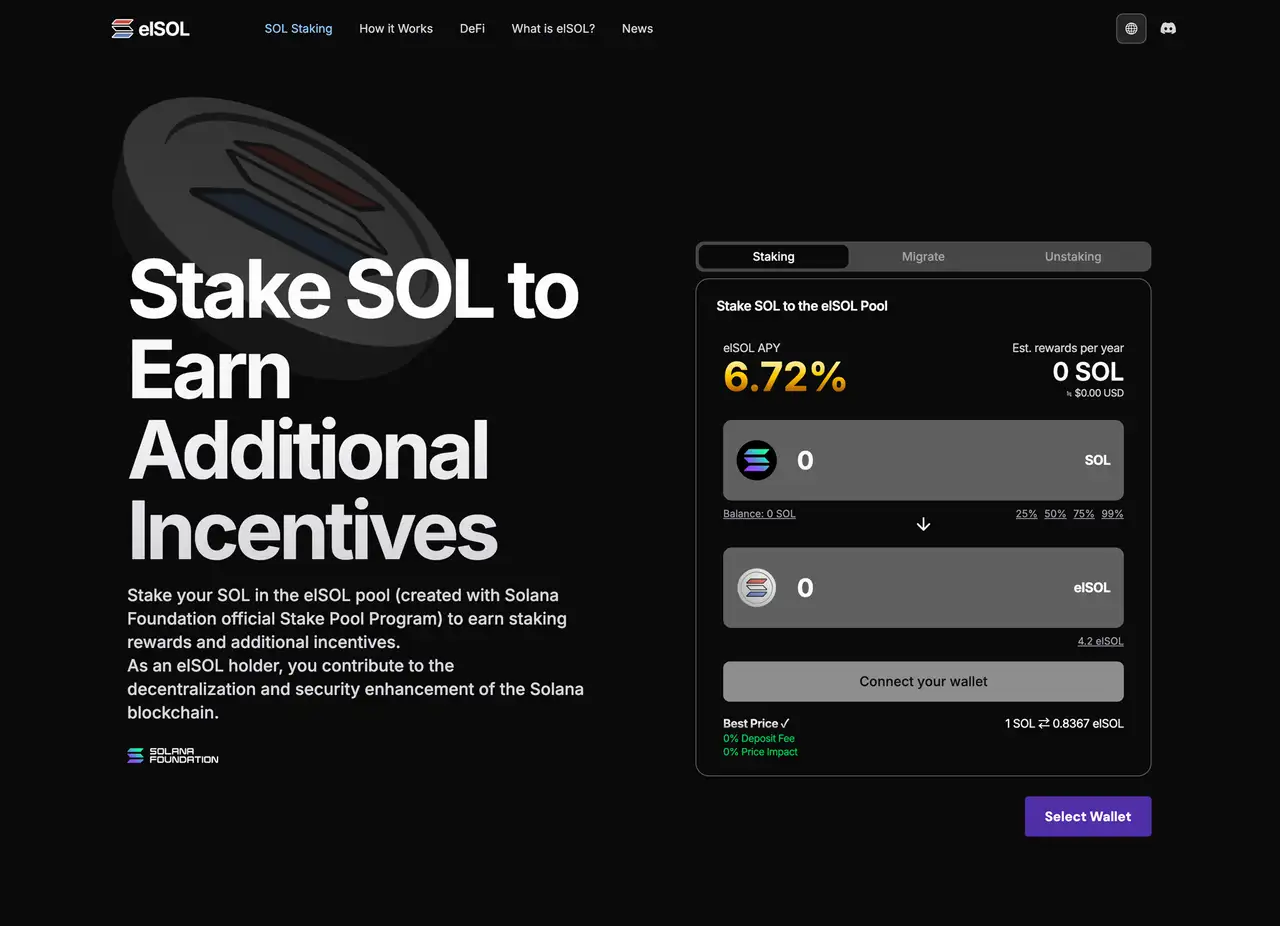

Traditional transaction sending services require attaching a Tip, often leading to cumulative costs in the hundreds of SOL. With ERPC’s SWQoS Endpoint, Tips are not required. Instead, users gain access to priority lanes through their holdings of elSOL.

elSOL is Solana’s LST (Liquid Staking Token), issued by staking SOL. Its value continuously increases relative to SOL as staking rewards accumulate in the pool, meaning it is not fixed at 1:1. For example, holding 1 elSOL over time becomes “1 elSOL = 1.1 SOL”, “1 elSOL = 1.2 SOL”, and so forth. At the same time, elSOL can always be redeemed back into SOL, preserving liquidity while earning rewards.

Moreover, the stake destination of elSOL is validators directly connected to ERPC. As more elSOL is held, the SWQoS BandWidth of these validators expands. elSOL holders contribute to strengthening ERPC’s overall stake connection BandWidth, and in return, they receive usage rights to that BandWidth. This enables fast and stable transaction delivery while simultaneously earning rewards.

elSOL - Solana LST: https://elsol.app/en

BandWidth Allocation (TPS Mechanism)

The TPS available on the shared SWQoS Endpoint is calculated as elSOL holdings ÷ 4.2, rounded down. For example, holding 10 elSOL grants 2 TPS. The actual usable TPS is capped at the lower of your plan’s maximum TPS and the TPS derived from your elSOL holdings. A Developer plan or higher is required, and all Bundle plans are included.

Access is available via the Validators DAO official Discord.

- Validators DAO Official Discord: https://discord.gg/C7ZQSrCkYR

Relation to Priority fee

Priority fee is important, but it is only applied after transactions have already passed through SWQoS lanes. Without SWQoS, raising Priority fee alone has little effect because the transaction may not reach the leader in the first place. In real-world operation, combining SWQoS with Priority fee is the effective approach.

Roles of ShredStream and gRPC

ShredStream is optimal for detecting signals at the fastest possible timing, while gRPC is effective for confirmation.

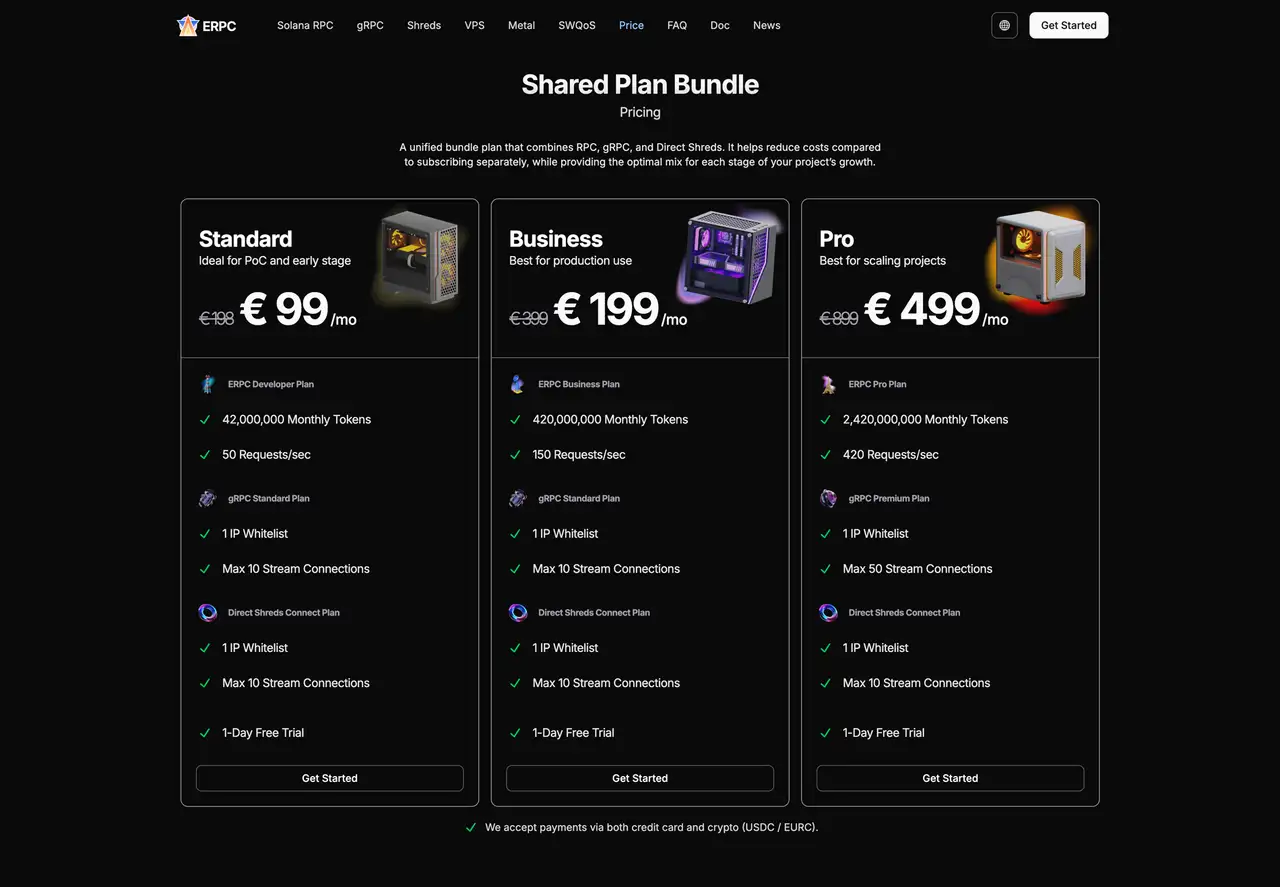

By joining a Bundle plan, users can access RPC, gRPC, and Shreds in one package, and with elSOL holdings, SWQoS BandWidth also becomes available. This enables end-to-end consistency from detection to confirmation, achieving both speed and stability.

Future Outlook

A SWQoS Market will be launched in the future. Validators will be able to connect their stake-derived BandWidth to ERPC and lease it out for incentives. By staking elSOL, holders will also be able to provide BandWidth to the market and earn additional incentives. This system connects validators and elSOL holders as providers with users as consumers, fostering a more efficient and resilient Solana ecosystem.

Validators interested in incentives through BandWidth leasing are invited to contact us via the Validators DAO official Discord.

In addition to incentives from BandWidth leasing through elSOL staking, early elSOL holders will also be eligible for an airdrop of Validators DAO’s $VLD token. For details, please refer to the whitepaper and litepaper available via the Validators DAO official Discord.

- Validators DAO Official Discord: https://discord.gg/C7ZQSrCkYR

Challenges ERPC and Validators DAO Solve

- Transaction failures and latency fluctuations common in standard RPC environments

- Performance throttling by many infrastructure providers

- Significant impact of network distance on communication quality

- Difficulty for smaller projects to access high-quality infrastructure

Through developing the open-source Solana NFT card game project Epics DAO, we faced firsthand the difficulty of securing a high-quality and high-speed Solana development environment. We built our own platform and now provide ERPC and SLV based on that expertise.

Financial applications are particularly mission-critical, where latency and errors directly impact user experience. With validators globally distributed and Web3-specific mechanisms layered in, Solana development is complex and has long suffered from delays and instability.

We provide the high-performance development foundation required to change this reality and contribute to improving both development and user experience across the Solana ecosystem. ERPC and SLV are positioned as part of this effort.

- ERPC Official Website: https://erpc.global/en

- SLV Official Website: https://slv.dev/en

- elSOL Official Website: https://elsol.app/en

- Epics DAO Official Website: https://epics.dev/en

- Validators DAO Official Discord: https://discord.gg/C7ZQSrCkYR

This content does not constitute investment advice. Please conduct your own research before making any decisions (NFA/DYOR).